2 min read |

Samra Zulfiqar

| January 8, 2026

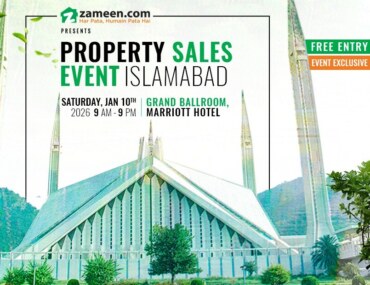

This January 10, Islamabad is set to witness an event that every real estate enthusiast and investor will want to part of. Zameen.com is bringing its Property Showcase …

4 min read |

Samra Zulfiqar

| January 7, 2026

Gujrat is on the brink of a commercial revolution, and at the heart of this transformation stands the Mall of Gujrat, the city’s first large-scale, urban-class commercial development. …

3 min read |

Samra Zulfiqar

| January 5, 2026

In the heart of Lahore’s Sukh Chayn Gardens Society, a new benchmark for modern living has emerged. Zameen Jade is more than just a residential project. It is …

3 min read |

Samra Zulfiqar

| December 31, 2025

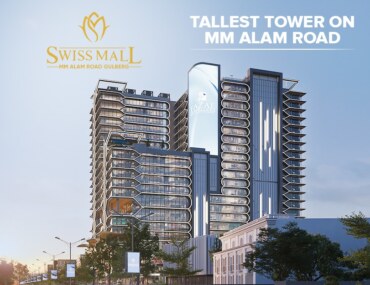

Living, working, and investing in Lahore just got exciting! Swiss Mall Gulberg on MM Alam Road isn’t just another address, it’s a lifestyle, a destination, and a smart …

4 min read |

Samra Zulfiqar

| December 30, 2025

In real estate, timing matters just as much as location. Opportunities that combine both are rare, and that is exactly what makes Grand Square Mall at Centre Point, …

4 min read |

Samra Zulfiqar

| December 29, 2025

Islamabad’s real estate market has long been a magnet for investors seeking high-return opportunities paired with lifestyle advantages. Among the most exciting prospects today is Grand Orchard, a …

4 min read |

Samra Zulfiqar

| December 26, 2025

In today’s market, buying property is no longer just about ownership. It is about securing long-term value, predictable returns, and peace of mind. Premier One at University Road …

4 min read |

Samra Zulfiqar

| December 24, 2025

For many Pakistanis, whether living locally or overseas, Murree has always held a special place. It’s where childhood memories were made, family holidays unfolded, and the mountains offered …

4 min read |

Samra Zulfiqar

| December 23, 2025

In a city where premium locations are becoming increasingly scarce, Gulberg 3 continues to stand tall as Lahore’s most resilient and rewarding real estate zone. For investors and …

3 min read |

Samra Zulfiqar

| December 19, 2025

Some investment decisions are best made after seeing the bigger picture, not just brochures, not just promises, but the location, the vision, and the people behind it. That’s …